Just How Far Could Gold Go?:

So, here we are half way through 2011 and gold has already risen more than it did in 2010. Can it really go much further? Well the debate rages.

We are not going to make a forecast in this piece, rather just share an insight into a couple of the macroeconomic drivers behind the recent rise and compare this bull run in prices to the great bull run that occurred in the early 1970s.

The price of gold in US dollars (USD) rose strongly during the 1970s for two clearly defined reasons: the formal severing of the USD from gold in August 1971 as the Bretton Woods agreement was terminated and the two oil induced aggressive inflation periods between 1973 and 1979. The current rally in gold has some similarities: confidence in fiat currencies has been knocked by mismanagement of various fiscal policies along with the resultant slack and protracted monetary response and quantitative easing (which is the other side of the same coin that you will find inflation on).

Gold has traditionally acted as a store of wealth in uncertain or troubled times. The issue holders of gold face though is how do you measure the worth of your gold if you perceive an ongoing devaluation in the purchasing power of fiat currencies particularly when those concerns relate to the global reserve currency? There are several ways to address this problem but we cannot discuss them here.

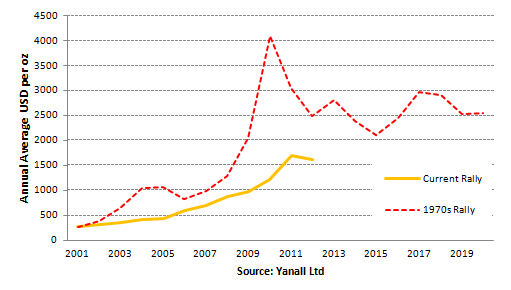

One approach we can share with you though is to look at the current rally in gold through the lens of the first great rally of the 1970s. In the chart above we have used annual average USD prices for gold, expressed the 1971-1981 period in today’s prices and then overlaid this time series on the one from 2001. Using this approach it can be seen that the recent run-up in USD prices is somewhat mooted this time round, achieving only about half the uplift so far. The question to ask though is will the current geopolitical conditions allow for a real acceleration in price momentum?

©Yanall Limited 2011. For permission to reproduce all or part of this work please email research@yanall.co.uk

Chart updated to March 2012